CCIN Brand guidelines

- February 2025

We use cookies to help you navigate efficiently and perform certain functions. You will find detailed information about all cookies under each consent category below.

The cookies that are categorized as "Necessary" are stored on your browser as they are essential for enabling the basic functionalities of the site. ...

Necessary cookies are required to enable the basic features of this site, such as providing secure log-in or adjusting your consent preferences. These cookies do not store any personally identifiable data.

Functional cookies help perform certain functionalities like sharing the content of the website on social media platforms, collecting feedback, and other third-party features.

Analytical cookies are used to understand how visitors interact with the website. These cookies help provide information on metrics such as the number of visitors, bounce rate, traffic source, etc.

Performance cookies are used to understand and analyze the key performance indexes of the website which helps in delivering a better user experience for the visitors.

Advertisement cookies are used to provide visitors with customized advertisements based on the pages you visited previously and to analyze the effectiveness of the ad campaigns.

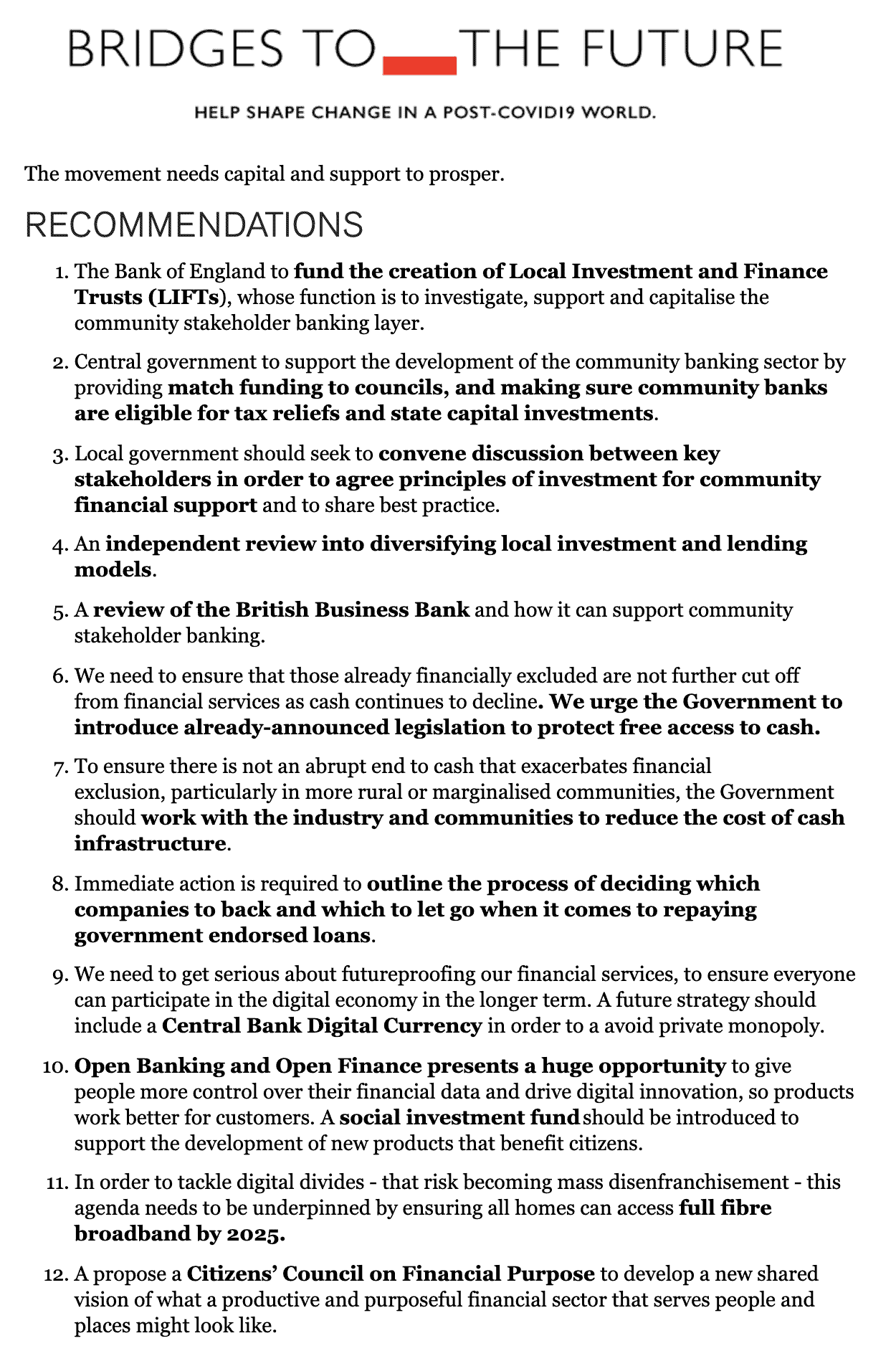

The latest report from The RSA (Royal Society for the encouragement of Arts, Manufactures and Commerce), Road to Resilience: how community financial services can help level-up Britain, outlines twelve recommendations to support community banking and build a more inclusive economy, including:

At almost exactly the moment that the UK Government officially abandoned the austerity strategy which had framed policy since the 2008 global financial crisis, the Covid-19 pandemic struck. As, once again, we have to rebuild a shattered economy, the question of fitness for purpose of our financial services system has re-emerged. Some of the problems of that system may have changed in the last 12 years but it is still in need of major reform, especially if it is to serve the organisations, communities and places most in need of support.

This report combines an analysis of some of the problems in our financial services system with the story of a group of RSA Fellows who are seeking to build a new financial architecture from the ground up. In so doing it speaks to the history, methodology and values of the Society. There is a long tradition of practical RSA-driven reform in financial services. These initiatives range from the first ‘Penny Banks’ – accounts that could be set up with tiny sums and thus radically altered the landscape of financial inclusion in Victorian England – to the creation of the modern ‘unforgeable’ bank note.

In more recent times we have looked more systemically at the foundations for reform. Tomorrow’s Company, (a major RSA project before being spun off as an independent charity) contributed to a stronger focus on the purpose and governance of major businesses, while Tomorrow’s Investor has led directly to significant reforms of our pension system. This report also reflects the methodology of today’s RSA, summarised as ‘thinking like a system and acting like an entrepreneur’.

On the one hand, there is a broad analysis of the limitations of the UK’s financial services, particularly in relation to a lack of support to SMEs, failing to serve some of the communities which this government is aiming to ‘level-up’ and disregarding the needs of those who are being left behind by a ‘cashless’ economy. On the other hand, the report describes the work of growing group of social entrepreneurs – many of them RSA Fellows – seeking to create national network of local banks.